QuickBooks is the most widely used small business accounting software for managing income and expenses and keeping track of a company’s financial health. It can be used to bill customers, pay bills, generate reports, and prepare tax returns.

QuickBooks is an essential piece of software for any company. It greatly simplifies and streamlines accounting, monitoring, and reporting and, for the most part, ensures that managing your company’s finances will be far more accessible.

There are numerous membership options available for QuickBooks Online. Multi-currency functionality is available on most QuickBooks Online subscription tiers. This is beneficial to companies that deal with worldwide clients and suppliers.

QuickBooks Online can be used with either a monthly or annual subscription. You’ll be able to access services tailored to your sort of business once you’ve signed up. There are other desktop versions available.

QuickBooks Online is compatible with other Intuit products. TurboTax (for preparing personal income tax returns) and ProConnect are two examples (tax software for accounting professionals).

It also works with a variety of other software and apps. To mention a few, they handle charitable donations, scheduling, time tracking, document management, payment processing, and inventory management.

How to Use Quickbooks for your Business

Customers can use QuickBooks to access a variety of financial tools. Each can assist small- to medium-sized business owners in handling their bookkeeping.

-

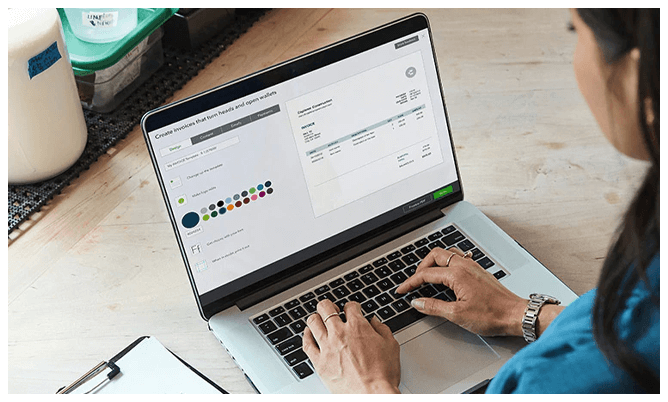

Track Invoices:

Invoices are simple to make and can be printed or emailed to customers. QuickBooks will automatically record your income and keep track of how much each customer owes you. You can see how much money you owe on your outstanding invoices and how many days they’ve been past due.

-

Tracking expenses and bills:

QuickBooks automatically keeps track of your bills and spending by connecting your bank and credit card accounts to QuickBooks, which downloads and categorizes your expenses. If you need to track a check or cash transaction manually, you may do so in minutes in QuickBooks. You may also add bills into QuickBooks as soon as you get them to help you keep track of upcoming payments.

-

Print Financial Statements:

You can produce financial statements that provide essential information about how your firm operates if you manage all of your cash inflow and outflow activities in QuickBooks.

-

Track worked hours and payroll:

Payroll calculation errors can result in costly penalties and disgruntled employees. QuickBooks provides a payroll option that can automatically calculate and process payroll as often as you need it.

QuickBooks can help you keep track of your employees’ working hours. The monitored hours are subsequently applied to your customer invoices (if billable) and your payroll. This ensures that every hour you pay your employees is accounted for when it comes time to bill a customer.

-

Inventory Tracking:

QuickBooks can keep track of your inventory’s quantity and cost. QuickBooks will automatically allocate a portion of your inventory to the cost of goods sold (COGS), an expense account that reduces your income when you sell inventory. QuickBooks can automatically remind you to order more when inventory levels are low.

-

Make taxes simple:

QuickBooks can accomplish the most important thing for your small business to make tax season less complicated. If you use QuickBooks throughout the year, you only have to print your financial statements around tax time. You can give your tax preparer direct access to your QuickBooks Online account so they can review your figures and print whatever information they need to prepare your return.

-

Online payment:

Offering clients the option to pay their invoices online is one of the most acceptable methods to boost your cash flow. Customers can pay online directly from their emailed invoice by using QuickBooks Payments. Other merchant services are similar to QuickBooks Payments. Because it’s fully connected with QuickBooks, the sale, credit card fee and cash deposit are all instantly recorded as they happen.

Benefits of using Quickbooks

For an entrepreneur or a small business, QuickBooks makes tax preparation simple. For individuals who are new to preparing tax information to pass on to a bookkeeper or accountant, the software is simple.

Through subsequent editions of the software, Intuit consistently improves the product. There are also many types of QuickBooks software that cater to different businesses, from sole proprietorships to large corporations.

Due to automated backup, financial data is safe and secure.

Aside from Intuit’s videos and articles, QuickBook tutorials are accessible in both video and text forms.

We’ve used QuickBooks before and can advise you on which version of accounting software is ideal for your company. We can help you choose a QuickBooks version, teach your employees to use the most up-to-date accounting software, or manage migration with other company software.

Recent Comments